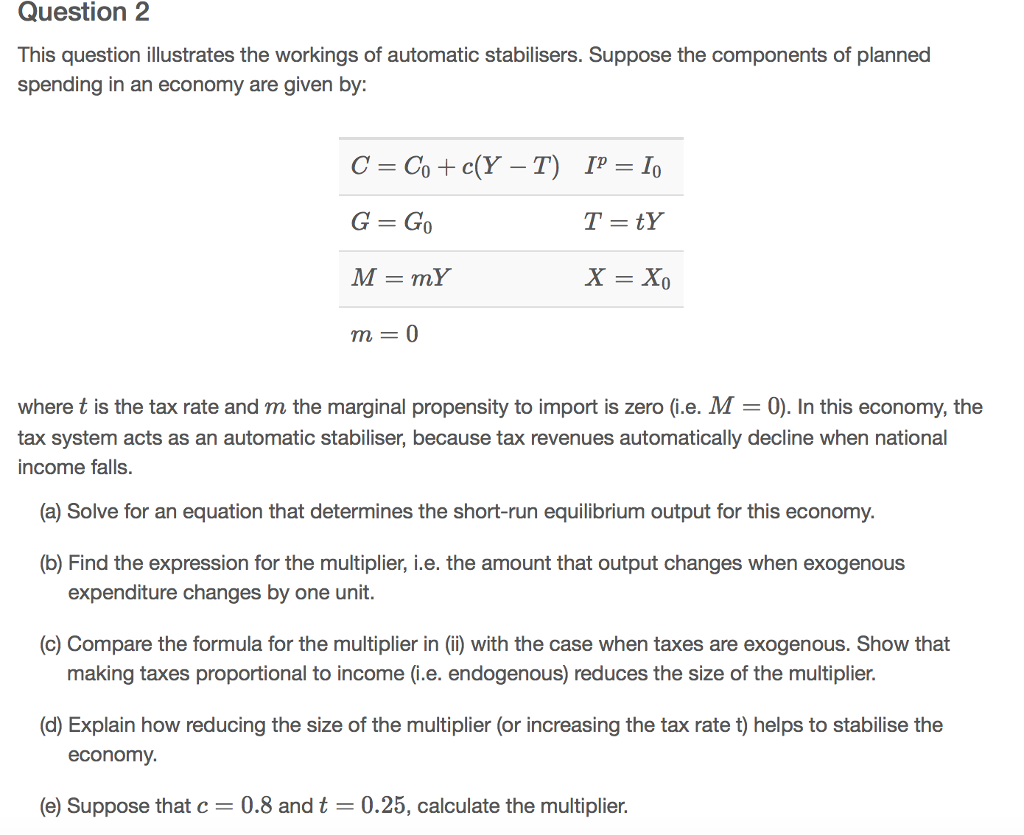

6 We simulate the impact of a negative demand shock under two scenarios. An automatic stabilizer, in this case a reduction in the marginal tax rate for workers, shifts the supply curve, resulting in a new equilibrium point, C, which results in a lesser reduction in production.Īuerbach, Alan J. Effect of automatic stabilizers on the economy We use simulations of the FRB/US model to examine the degree to which the automatic fiscal stabilizers considered above help or hinder the performance of the broader economy. The original equilibrium point, A, would shift to B without an automatic stabilizer, resulting in a massive loss in production. In this example, a decrease in demand for a good from a shock to the economy reduces the demand for labor, reducing the amount paid to workers. Most automatic stabilizers act to increase or decrease consumption (depending on whether the economy is to be accelerated or slowed) by increasing or decreasing income levels. The federal government has reduced the effect of automatic stabilizers during boom times over the past 45 years by limiting the maximum marginal tax rate (Auerbach &įeenberg, 2000). In particular, automatic stabilizers provide income replacement immediately when unemployment starts to rise.

The same can be said for wealth redistribution programs like unemployment compensation during a recession (“Automatic stabilizers”a, n.d.). Automatic stabilizers are usually defined as those elements of fiscal policy which reduce tax burdens and increase public spending without discretionary government action. Progressive taxes work as a stabilizer on the economy in a boom period by increasing at a rate greater than income increases (“Automatic stabilizers”, n.d.). One of the most common automatic stabilizers used is taxation. Automatic stabilizer - Wikipedia Automatic stabilizer In macroeconomics, automatic stabilizers are features of the structure of modern government budgets, particularly income taxes and welfare spending, that act to damp out fluctuations in real GDP. The point of an automatic stabilizer is to reduce the multiple of the effect (“Automatic stabilizers”b, n.d.). Despite the importance of automatic stabilizers for stabilizing the economy, very little work has been done on automatic stabilization in the last 20 years (Blanchard, 2006. For simplicity, we assume, as others, that the revenue elasticity is one and that spending elasticity is zero. Automatic stabilizers are usually defined as those elements of fiscal policy which mitigate output fluctuations without discretionary government action.

A simple example can illustrate why using the spending ratio to measure the size of the automatic stabilizers is inappropriate. Changes in these factors have a multiple effect on the aggregate demand curve. automatic stabilizers, particularly when the elasticity of spending is explicitly assumed to be zero. Some of the factors that can destabilize an economy are changes in consumption, investment, or exports. They are a key part of Keynesian economics. Automatic stabilizers are systems set up in order to reduce fluctuations in a country’s real GDP, both positive and negative without any overt government action (“Automatic stabiliser,” 2008).

0 kommentar(er)

0 kommentar(er)